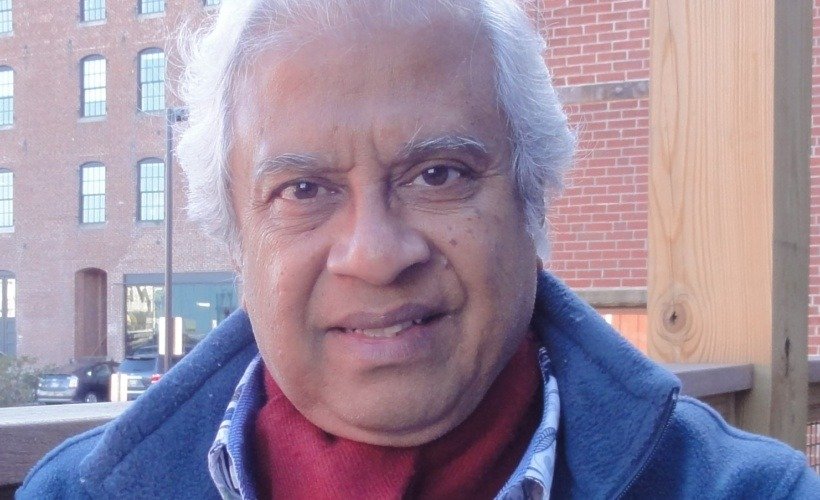

SATYENDRA NAYAK explains the concept of money and how its influences the working and functioning of the economy

Money is an institution that has been the cornerstone of our civilizations for ages. Man’s overwhelming desire to improve the quality and standard of life has been the guiding force behind his continuing effort to invent, innovate and adapt its institutions over time. Every attempt to change its institutional structure to improve its efficiency has been guided by rich and scholarly theories, analyses, thought leaders, and policy prescriptions.

What is money? Money is a liability, a promise to pay. The currency notes we are holding are the liability or promises of the Reserve Bank of India to pay. The bank deposits and cheques and credits are the liabilities of the banks to pay. Money is only a means to an end. The end is not only economic prosperity but also the maximum welfare of all. From salt, rice, cattle, and gold and silver coins to paper currency, plastic cards, and now digital, and also crypto-currencies, money has, over millennia, adapted its shape and form to perform the same function of a measure of economic value and exchange.

Money is held by society in the form of currency notes and bank deposits and credits. This forms the money supply in the economy. It is created by the central banks and commercial banks, to meet the requirements of society (households, businesses, and governments). The central bank is the guardian of money. It enjoys the monopoly of currency issue, and licenses and regulates banks. Along with the banks, it creates and supplies money to the society.

Money is the lifeblood of an economy. But how does it influence the functioning of an economy? Money is used for spending or lending. One man’s spending is another man’s income. Spending creates demand for goods and services. Production supplies goods and services to meet the demand. Lending is also used for spending. This cycle of spending, income, and output keeps the economy, moving, rolling, and growing. The private economy produces output, generates income, and spends on consumption and investment, and also saves. The Government collects taxes, borrows from the public and the Reserve Bank, and spends. The economy sustains and grows on this income-spending cycle through money.

Quantity of Money and Rate of Interest

The determinants of the functioning of an economy are the quantity of money and its growth, and the cost of money, which is the rate of interest. An economy needs the right quantity of money, just as a body has to have normal blood pressure. How much money is required by society is also governed by the size of the cycle of income and expenditure and its momentum. An abnormal quantity of money in an economy can create adverse economic effects like inflation. An excessive quantity of money that does not result in expansions in the output and supplies of goods and services causes prices to rise. The Reserve Bank of India which controls the money supply to the optimum level, aims to keep economic growth and employment high and inflation under control. In this exercise, it declares the target inflation rate in the conduct of their policy of rate of interest and growth rate of the money supply. The rate of interest is decided by the Reserve Bank of India to generate the right quantity and growth of money that is productive in creating economic growth and not causing inflation.

Banking: Transformation of Money

The banking system is virtually the lifeblood of all economic activities. It can be compared with the blood circulation network and system in the human body. It accepts money and creates credit and stimulates growth. In this process, it transforms the financial savings of society into productive flows of goods and services and incomes through credit. This process is called the intermediation of financial savings between lenders and borrowers. Money drives the circle of production and income. It is the harbinger of output creation, income and employment generation, and growth. The faster the cycle moves, the faster will the economic growth of the economy. A banking system that moves and accelerates this cycle of deposits-credit-output-income faster generates higher growth in the economy.

A well-spread-out and efficient banking system can contribute to more efficient growth and development of the economy; through its network of branches, its currency and coins circulation, payments mechanism, and savings and credit facilities to the community. In addition to providing a cash and payments system, it also serves another significant economic function of promoting and mobilising the savings of the community for lending to those who want to invest in productive economic activities like trading and production. It serves as the growth engine of the economy by promoting investments from savings. The banking system in India is aimed to be more inclusive by having a wide and extensive branch network reaching also to the unbanked regions to mobilise their savings for productive use.

Currency, Credit Cards, and Plastic Money

The credit card has been a great innovation in money. While currency notes are essential, credit cards replace the need for currency for transactions. It has considerably lowered the transaction demand for currency. Society’s demand for currency has gone down and so has the responsibility of a central bank to supply currency. The central bank incurs costs in supplying currency to the public. To the extent that credit cards reduce the demand for currency, the total cost of the central bank in supplying currency to the public is reduced. That is an advantage to the community.

Digital Banking

Internet and digital technologies have revolutionised the function of banking and financial services globally. Transactions are instant and at the least cost. Wireless mobile technology and phones have further facilitated mobile access to information and the execution of transactions. Both the hardware and software have been progressing so fast to cause a sea change in our day-to-day lives and so in banking. With the progressive digitalization of banking and only aspect of money which has remained physical is the paper currency. Naturally, the demand for currency is also gradually declining globally.

What Money Costs?

Both the coins and currency production have metal, paper, minting, and printing cost. Money is a service provided by the central banks and banking institutions. Money is the holder’s asset, but it is the liability of issuers or creators of money. In the case of currency, it is the liability of central banks in currency, and of banks for the bank deposits and cheques. Like any other economic service, money has cost. The overall cost of issuing currency to the Reserve Bank is around 1% of the value of the currency. On demonetisation of currency notes conducted in 2016 printing new notes cost `8000 crores for 916 crores notes and per note cost worked out to `8. However, in value terms, the cost comes to 1.7% and 0.4% for `500 and `2000 rupee notes respectively.

Money and GDP

The supply of money in India comprising currency and bank deposits in 2023 was `223 lakh crores recording 9.5% growth over the earlier year. The currency in circulation was `33 lakh crores forming 15% of the money supply and growing at 8%. Bank deposits at `190 lakh crores grew at 9%.

India’s GDP in 2023 was `270 lakh crores growing at 7.1%. Since the money supply in the economy is 82% of the national income (GDP), the income velocity of money is 1.2. Money turns over 1.2 times in a year to generate income. At the GDP at $3.75 trillion, India emerged as the fifth largest economy in the world after the US, China, Japan, and Germany. The Reserve Bank’s interest rate for lending was 6.5% and the inflation rate at remained at 6%.