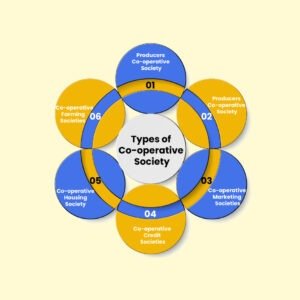

V. B. Prabhu Verlekar, explains the various issues faced by co-operative societies in the State.

Every year during the budget session, the State Assembly debates on defaulting co-operative credit societies. This year, the assurance of the Minister for Co-operation to legislate a cap on deposit interest @12% is not the solution. Further, no government will ever be able to bring down Non-Performing Assets (NPA) to zero as promised.

It is reported that Rs. 12,000 crores worth of deposits of Goans are lying invested with different co-operative societies. There are about 2,500 co-operative credit societies in Goa under the control of the Goa Registrar of Co-operative Societies (RCS). Multistate Multi-Purpose Co-operative Societies (MSCS) do not come under Goa RCS but are administered by Central Co-operative Registrar from New Delhi.

Practically, these MSCS societies behave as if they are autonomous co operative organisations and garner thousands of crores of deposits. One such society is on a spree of inaugurating branches in Goa through prominent personalities and politicians, as deposit collection centres and mobilises deposits through regular attractive advertisements of happy senior citizen couple and smiling cheerful young family – in print, digital, electronic media and radio with offer of high interest rates. Various programmes are liberally sponsored on TV and otherwise.

Being a multi-purpose society, it also engages in running hotels, real estate, tour operating business, investment agency. Its website displays all information except, the most essential – the audited financial statements and audit report – as if there is something to hide. Another such Society, by paying heavy commission to agents, mobilises deposits and recruits new agents to collects crores of deposits from family members, friends, and acquaintances.

Goa government is in the dark about their operations and financial position in the absence of any legislation to regulate MSCS. Early action is needed to safeguard the interest of Goan depositors. Due to low interest rates offered by nationalised banks, depositors are tempted to invest at high rates, unmindful of the safety of their principal invested.

Most of the co-operative credit societies, except Employees Credit Societies and societies managed though retired bank officials are financially weak and

unprofessionally managed by persons who lack financial skills and experience. To attract deposits in view of competition, they offer high interest rates of around 12- 13% and lend at 17-18% to unsafe high risk borrowers where repayments are doubtful. With the result overdue (NPAs) of these credit societies are rising to unsafe levels.

The Office of Registrar of Co-operative Societies is bureaucratic riddled with red tape. There is no special technical staff or mechanism to isolate such societies to provide guidance and corrective action. There is no internal surveillance system or other mechanism for monitoring. This issue is further compounded with frequent transfers of Registrars whose tenure should

be minimum three years to get proper results. CCSs are not supervised by the Reserve Bank of India and are also not covered under deposit insurance scheme under the Deposit Insurance and Credit Guarantee Corporation (DICGC).

The original objective of promoting cooperative credit societies was to make available funds to members at reasonable rates through mutual contribution of members to safe guard from clutches of money lenders. With the penetration of banking and credit facilities to rural and urban areas through a network of nationalised and private banks, NonBanking Financial Companies (NBFCs), fin-techs, and Pradhan Mantri MUDRA Yojana (PMMY), loans are available at low interest rates. Thus, role of credit societies is significantly reduced in the Indian economy. In Marcela gram-panchayat, there are about 20 credit societies, 5 nationalised and 2 private banks; this is same case throughout Goa. The government should therefore discourage registration of new credit societies by raising the capital bar significantly.

Government should also modernise existing societies by providing them integrated banking software which will keep record of each and every transaction, provide information about day to day inward and outward fund flows, cost of funds, returns on advances, draw daily profit and loss account etc. This should be made available to all societies free of charge or nominal rate. A special technical cell in the Registrar’s office should continuously monitor and isolate weak societies for corrective action. The Government should provide standard procedure guidelines for recovery of loan dues to be adopted as policy by all co-operative credit societies. Board Members should be made accountable for violation of recovery guidelines in case of any default in loan due to such violation.

The Government should also take initiative for professional management of these cooperatives through competent, trained, and qualified persons so that the cooperative as a business enterprise prospers.

In order to imbibe professionalism in the functioning of societies, it is imperative that co-operative education and training in relevant areas are organised by government at regular intervals for all categories of cooperative personnel so as to upgrade their awareness and competences so essential for cooperative success.

All these measures are secondary. Primarily it is absolutely essential for every investor to know that high interest not aligned with the market is fraught with great risks. No amount of agitations, protests, police complaints, and court fights is going to help them to get their hard earned life savings. Always remember the dictum of ‘Caveat Emptor’ (Buyer Beware).