Amiya Sahu discusses the top winners and losers on the Indian equity market during the pandemic.

The Indian equity market, like many others, has made a V-Shaped recovery. The Sensex again scaled the 40,000 mark in October 2020. The COVID-19 pandemic which led to a sharp, ‘jaw-drop’, fall of the market has changed the economic conditions in several aspects. For more than a quarter, the economic activities came to a grinding halt when we were asked to lock ourselves in our homes. Although ‘normalcy’ is still far away, the stock market has preceded it. In this article, I discuss the top winner and losers during this extraordinary period.

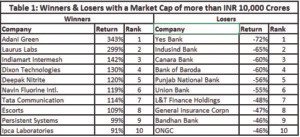

Using 9 months data, the list of winners and losers has been identified. They form an interesting set of companies.  The first set is of large companies that have a market cap of greater than INR 10,000 crores (refer Table 1). The increase / decrease in prices of these companies was taken from 01 January 2020 to 30 September 2020. While the winners were from different sectors, most of the losers belong to the banking and financial services sector. Adani Green created maximum wealth during the period with an increase in the price of about 343%. The company which lost most in value was Yes Bank at -ve 72%.

The first set is of large companies that have a market cap of greater than INR 10,000 crores (refer Table 1). The increase / decrease in prices of these companies was taken from 01 January 2020 to 30 September 2020. While the winners were from different sectors, most of the losers belong to the banking and financial services sector. Adani Green created maximum wealth during the period with an increase in the price of about 343%. The company which lost most in value was Yes Bank at -ve 72%.

The second set of winners and losers were identified which belong to the market cap club between INR 10,000 and 1000 crores (refer Table 2). Alok industries tops the list which gave a whopping return of more than 500% during the period.

The winners’ list was dominated by the pharma and chemical sector. Three companies from Kishore Biyani promoted Future Group were the top losers with return as low as -ve 78%.

The winners’ list was dominated by the pharma and chemical sector. Three companies from Kishore Biyani promoted Future Group were the top losers with return as low as -ve 78%.

Understanding why companies gained or lost so much in value is a key question. One of the foremost reasons for an increase (decrease) in value is a rise (fall) in their earnings. Looking at changes in earnings per share (EPS) of these companies, it was found that EPS of four of the top winners moved from -ve to +ve, while it increased for others. For example, the EPS of Adani Green increased from INR -0,69 in Jun 2019 to INR 1.79 in June 2020. Aarti Drugs reported an increase of 144% in earnings from June 2019 to June 2020. On the other hand, the reported EPS for Future Lifestyle Fashions went down from INR 10.77 to INR -17.18.

At this point, let’s answer two important questions. (1) What is our take-home from this analysis? and (2) How do we select companies to be part of our portfolio?

Financial performance is one of the key drivers of the value of a company. We have to understand and keep monitoring it. We should look at companies with strong fundamentals to be included in the portfolio. Since we need to diversify our investment into different sectors, we have to select sector winners.

We should not conclude to buy/ sell from the list given above, since the fundamentals change over time. Please consult an investment or wealth advisor for investing