The writer decodes the Union Budget 2024 which has set the stage for long-term growth

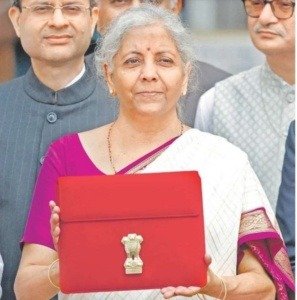

Finance Minister, Nirmala Sitharaman recently presented the record seventh consecutive Budget against the backdrop of India’s steady growth amid global economic uncertainties. Following the roadmap of Viksit Bharat@2047, the Budget provided continuity in the Government’s fiscal policy with a thrust on creating a future-ready workforce and fostering an enabling business environment.

Fiscal Report

The Budget primarily focused on 9 key priorities which included Agriculture Productivity, Employment and Skilling, Manufacturing and Services, Infrastructure, Innovation and Next Generation Reforms. The buoyancy in tax collections and the bumper dividend from the Reserve Bank of India provided headspace to the Government to not only spur growth but to cut its fiscal deficit as well. The government has trimmed the fiscal deficit target to 4.9% as compared to the 5.1% in the Interim Budget, with a commitment to reach below 4.5% by FY 2025–26.

Employment Linked Incentives

Taking cues from its Productivity Linked Incentives (PLI) Schemes, the Government will implement Employment Linked Incentive Schemes to focus on those entering the work force for the first time as well as for providing support to the employers. The rationale of the schemes is to create demand for new employment, encourage women participation in the work force and upskill the youth through skilling loans and internships. These large-scale schemes with allocations over multiple years will boost the formalisation of employment through the increased registrations under the Employees’ Provident Fund Organisation (EPFO) as well as make the youth more employable. While the Budget should not be viewed as a quick fix to address structural challenges, the fine tuning of the caveats during the roll out and minimal compliance obligations can catapult the drive to capitalise on the country’s demographic dividend. The Government has also announced the setting up of ‘plug and play’ industrial parks in 100 cities, and Goa should throw its hat in the ring to take advantage of the world class infrastructure facilities.

Enabling Small and Medium Businesses

Although the lowering of tax rates for firms and Limited Liability Partnerships (LLPs) was not on the cards, the credit guarantee scheme for facilitating Micro, Small and Medium Enterprises (MSME) term loans for purchase of machineries without collateral guarantees will ease the flow of credit. Further, the revamped credit assessment model based on the scoring of digital footprints of MSMEs in the economy will widen the credit net to include the informal MSME sector, as well.

The proposals for decriminalisation and rationalisation of withholding taxes aligns with the goal of using TDS/TCS primarily as an accounting trail rather than a revenue generating tool. While the increase in eligible limits for remuneration to working partners is a welcome step, the proposal to levy TDS at 10% on payment of salary, remuneration and interest to partners by the partnership firm exceeding a mere Rs. 20,000 will lead to several practical challenges. The current fields in the Income Tax Returns and Tax Audit Reports already provide adequate tracking mechanisms, and the introduction of withholding tax will now result in another layer of compliance for partnership firms.

Personal Taxation

While there has been a marginal tweaking in the slab rates in the new tax regime, the popular expectation of raising the basic threshold limits and substantially increasing the rebate under Section 87A was not met. The benefits of standard deduction and deduction from family pension under the new tax regime have been increased to Rs. 75,000 and Rs. 25,000 respectively, which will alleviate some of the financial burden of rising household costs.

Taxation of Capital Gains

The highly debated changes in taxation of capital gains followed by break-even point comparisons have caught everyone’s attention. The hike in Securities Transaction Tax (STT) for Futures and Options echoes the sentiments of the Economic Survey regarding the high participation of retail investors in high-risk products. While the tax rates for long term and short-term capital assets have been rejigged, it is the removal of indexation benefits which will have a significant impact on taxpayers. The Indexation benefit was available for calculating long term capital assets for real estate under the Income Tax laws to offset the inflationary trends and determine the real appreciation in the value of the asset. The change will not only impact the taxation but will also affect the amounts to be invested in specified assets to avail capital gains tax exemption.

As a principle, simplification of provisions should not adversely affect taxpayer’s income. Grandfathering the gains up to the date of the budging or provide the new tax rates as an alternative taxation option to the tax payers are other options to simplify the capital gains tax regime. The Income Tax already provides a multiple-choice taxation regime for individuals, startups and corporates and this alternative capital gains scheme could eliminate the anxiety around the transactions which have been entered in the transitional period after the Budget speech but before the enactment.

Providing Investor Friendly Measures

Foreign Companies that are planning to invest in India will be considerably benefitted by the reduction of tax rates from 40% to 35%. The announcement for development of climate finance taxonomy and simplification of Foreign Direct Investments (FDI) Rules will drive sustainable growth and ensure further investment in India. A missed opportunity in the Budget is not extending the concessional rate for taxes for new manufacturing companies, which would have promoted India as the global manufacturing hub. The divisive Angel Tax provisions had led to prolonged assessments and needless burdens on the startup community. Abolishing these provisions are a welcome step to fostering innovation and stimulating investments for domestic and international funds. The proposals in buyback taxation however, will dampen investor sentiment, as the entire buy back consideration will now be treated as deemed dividend while the cost of acquisition of the shares bought back would be treated as a capital loss. The proposal could lead to situations where the taxpayers are taxed at a higher tax slab rate as well situations where the buyback has taken place at par/ loss and the taxes still need to be paid on the gross consideration.

Minimising Litigation

The proposal to have a comprehensive review of the Income Tax Act, 1961 within six months is a significant reform to simplify and rationalise the statute. While the idea has been in discussion for quite some time, the short timelines for review make it imperative to have a dialogue with all stakeholders in order to avoid any interpretational issues of the new provisions.

The major initiative of reintroducing the Direct Tax ‘Vivad se Vishwas’ Scheme aims to settle pending tax disputes amicably and showcases the government’s proactive stance on minimizing litigation. Additionally, measures such as streamlining reassessment timelines, increasing the monetary thresholds for filing of appeals by the tax authorities and enhancing safe harbour rules for transfer pricing are aimed at providing much needed tax certainty.

On the indirect tax front, the proposal to rationalise and simplify the GST and Custom Duty rate structures will settle duty inversion and classification dispute cases. The amendment for waiver of interest/ penalty on full tax payment before 31st March 2025 for notices/ orders issued from FY 2017 18 to FY 2019-20 will provide much needed relief for cases which had arisen in the nascent stages of GST. Further, empowering the Government to regularize non-levy or short levy of tax due to any general practice prevalent in trade is a progressive amendment that will facilitate taxpayers.

Overall, the Union Budget has addressed the immediate needs and set the stage for longterm growth with its focus on capitalising on the demographic dividend, simplification of taxation and its various initiatives for the ease of doing business. With just around half the fiscal year to go till the next Budget, the Government will now have to accelerate the implementation at full throttle.

The writer is a practicing Chartered Accountant and Chairman of GCCI’s Taxation Committee. Email: carohanbhandare@gmail.com