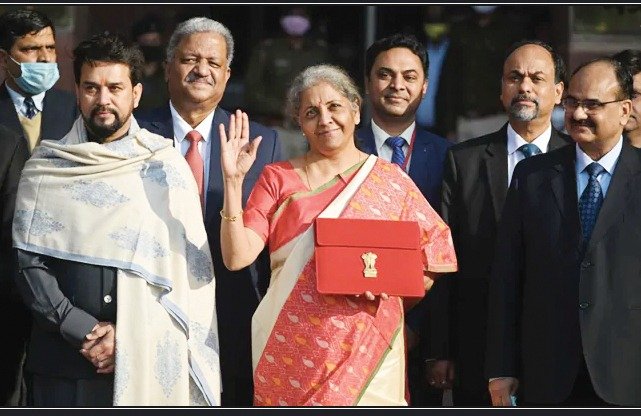

In the aftermath of the pandemic, the Union Budget 2021 was presented which has placed emphasis on infrastructure, healthcare, privatisation and other aspects, in order to boost growth

Never-seen-before times call for never-seen-before measures. This time around, the lasting impression of the Union Budget would not only be measured in numbers, but also in alphabets, i.e. U, V, W and K-shaped recoveries. But despite being one of the toughest years, the Union Budget 2021 presented by the Finance Minister, has ramped up on infrastructure, healthcare, privatisation and digitisation, giving equal importance to boost immediate post pandemic recovery as well as medium term growth. These sentiments were also shared by the financial markets, which posted the best performance on a Budget Day since 1999. This Budget; along with the previous ‘Atmanirbhar’ packages could be the booster dose to spur growth.

The Highlights of the Budget are:

Health & Infrastructure

The highest ever healthcare allocation in the budget would strengthen the public health infrastructure, which was under severe stress due to the pandemic. The enhanced investment in infrastructure, particularly the record allocation for ministries of railway and highways would be a key enabler of gross domestic product going forward.

The capital expenditure will have a high multiplier effect and could start the virtuous cycle to spur growth. The National Monetisation Pipeline could be a game changer if implemented successfully, and could help unlock the value of investment made in public assets which may have not yielded potential returns so far.

‘Aam Aadmi’

No bad news equals good news. Apprehensions of the return of Wealth Tax, Covid Cess, Increase in Capital Gains Tax, new HNI surcharges etc. did not see the light of the day.

There were certain expectations of a higher standard deduction and increase in deduction for health expenses but that would be nitpicking. The Budget has proposed to exempt the senior citizens of 75 years of age and above from filing income tax returns in case pension income and interest income are their only annual income source, wherein the Bank would deduct the necessary taxes on the income. The Income Tax returns will now also be prefilled with Interest, Dividend and Capital Gains for easier filing and ‘Jhatpat’ processing.

Small Businesses

The Government has been clear that the Income Tax rates are competitive enough and do not require any restructuring. After the recent change in the definition of MSME, the Government has encouraged taxpayers to adopt formal business structures by widening the threshold of a ‘Small Company’, under the Companies Act, 2013. Similarly, the Budget has proposed to decriminalise certain lapses under the Limited Liability Partnership Act and reduce the rigour of penalties, with an objective to improve the ease of doing business.

To incentivise the digital economy, the limit of turnover for tax audit has been increased to `10 crores from `5 crores for entities carrying out 95% transactions digitally. To reduce tax disputes, the Dispute Resolution Committee is proposed to be set up for smaller taxpayers with taxable income up to `50 lakh and disputed income up to `10 lakhs.

As per the Economic Survey 2020-21, Income tax refunds to nearly 8.2 lakh small businesses worth `5,204 crores have been issued with the objective to help the MSMEs to carry on their business activities.

Startups

The new relaxations in incorporation and operations of the One Person Company (OPC) seem to be aimed at startups. The reduction in residency limits for an Indian citizen to incorporate OPCs as well as the incorporation of OPCs by Non Resident Indians could possibly attract NRIs to venture into the startup ecosystem.

Further, rules for fast tracking mergers between startups have also been notified. Under Income Tax, the Budget has proposed to extend the sunset dates for deduction of profits (Section 80-IAC) and Capital Gains Exemption on Investment (Section 54GB) for one more financial year.

Statutory Timelines

The recent years have seen the overlapping of multiple statutory deadlines relating to Income Taxes, Goods and Service Tax and Ministry of Corporate Affairs, making it imperative to plan all deliverables effectively. Reducing timelines even further, the Budget has now proposed to reduce the time limit of filing belated/ revised returns to 3 months prior to the end of the relevant assessment year (i.e. 31st December) or before the completion of assessment, whichever is earlier.

Except in cases of serious tax evasion, assessment proceedings in the rest of the cases can now be reopened only up to three years, against the earlier time limit of six years. With the advancement of technology and separate requirements of each statute, robust documentation and automation of small tasks are the need of the hour to keep pace with the shorter timelines.

Digitisation

Although the terms Artificial Intelligence and Data analytics are largely associated by the general public with robots and tech giants respectively, we may soon associate these terms with our taxation systems. Relying on its robust tech infrastructure, the Budget has proposed that the input tax credit can now be availed provided the amounts feature in the electronic GSTR 2A and GSTR 2B. Such is the power of data analytics, that even the independent audit mandated under the GST law has now been substituted for the taxpayer’s self-certification. The Budget has also proposed to deploy these technologies to curb the menace of fake bills in the months to come.

After implementing Faceless Assessments and Faceless Appeals, the Budget has now proposed Faceless Income Tax Appellate Tribunals, which would be conducted electronically, as well. The Ministry of Corporate Affairs is also catching up with its new tech driven V.3.0 of MCA-21 with high scalability and capabilities for advanced analytics.

Privatisation

The increase in FDI Limit in insurance companies from 49% to 74%, and focus on stressed assets by creating asset management and reconstruction companies are welcome measures. The Government has reiterated its commitment to meet the ambitious targets of divestment, and would need to make serious efforts to convince the buyers looking for a hard bargain in these economic conditions.

Rationalising Multiple Statutes

The most common compliance problem in India is that the taxpayer does not know which statutes are applicable to him. Further, the statutes themselves are sometimes not harmoniously integrated.

After consolidating multiple labour laws in to four comprehensive Labour Codes, the Budget has now proposed to consolidate four important laws governing the capital markets and securities into a rationalized single Securities Markets Code. The modern framework would be clear and help in operational efficiency.

Decoding the Statutes

There were several uncertainties in the statutes wherein the assessees, the Government and Courts had held divergent views. The Government has now amended the laws in respect of income tax matters relating to depreciation of goodwill and the allowance of delayed payments of employee contributions, and GST matters relating to Input Tax Credit and the Doctrine of Mutuality.

Focus Goa

The Rs 300-crore financial package announced in the Union Budget for the celebration of Goa’s 60th year of Liberation has received a resounding welcome. The inclusion of Goa’s name for the investment in modern fishing harbours could have been the cherry on the cake. The outlay in the budgeted vaccination expenditure could act as a catalyst to revive the tourism, hospitality and aviation sector.

Summary

The Prime Minister had announced that the Budget 2021 is to be seen as a continuation of the series of 4-5 mini budgets of 2020. To summarise using the television show analogy, we are now in Season 6 of the Budget, which for the first time is also available on an app. Like every smart show, we would need multiple viewings to find all the connections and Easter eggs. No new villainous characters such as Covid Cess and Wealth Tax were introduced in this season.

However, all doors to a Money Heist have been closed due to the new stringent assessment and penal provisions on the Direct and Indirect Tax front. The Harvey Specters would now have to assist their clients to communicate electronically to faceless centres and tribunals. The Government has yet again won the Game of Thrones by converting their tax positions on Goodwill, ITC credit etc. into law. The pandemic may have ruffled the economic House of Cards, but the vaccine drive has completely changed the storyline. The quick response by the Government along with the growth oriented Budget has set the stage for the soon to be premiering Season Finale Episode: ‘Atmanirbhar’ Bharat.

Centre to develop Goa into country’s first fisheries hub, invest Rs 400 crore

Union Fisheries Minister Giriraj Singh has announced an investment of Rs 400 crores in Goa for making the coastal State a fisheries hub in India.

As per the Union Minister, Goa has the potential for the highest fish production in the country and it has the capacity to become a fisheries hub.

He further informed that the centre has already considered an investment of Rs 400 crores in the fisheries sector of Goa, which will also be jointly raised by the central government, state fisheries board, and others.

Out of the said amount, the Union Government has already sanctioned Rs 41.7 crores to the State, which will help in reviving the fisheries industry and ensure safe fishing.

The plan of making Goa a fisheries hub also includes the creation of 30 fish landing jetties, so that fishermen are able to anchor their boats near their villages.

These jetties will be linked to the mainstream by constructing roads. Goa already has 9 landing jetties that are used for tourism and fishing purposes.

According to the Union Minister, the Goa-based CSIR-National Institute of Oceanography has discovered that 200 sq km area in the coastal State is feasible to implement cage culture (an aquaculture production system where fishes are held in floating net pens).

He further informed that the issue was raised with the Central Marine Fisheries Research Institute, which certified that 72 sq km area of the State can be brought under cage culture, taking into view the fact that the State government must ensure that tourism of Goa will not be affected.

An area of 72 sq km has the capacity to install 30 lakh cages. This will further encourage safe marine cultivation for the fishing sector as Goa has the potential to have the highest fish production in the country.

The Union Government has also been planning to appoint ‘Sagar Mitra’ for each of the 70 fishing villages in Goa, who will further help fishermen liaison with the government.

Besides, there are also plans to establish a seaweed and ornamental fish complex in the State, as seaweed is a 15 million dollar business across the world, and Singh stated that Goa is capable of competing for a share of this market